[Extension of Eligibility Period] Immediate Depreciation or Tax Credit for Capital Investment in ERS Systems: Strengthening Small and Medium-Sized Enterprises through Organic Waste Resource Recovery

— Rapid Fermentation and Drying of Livestock Manure, Food Residue, Plant Waste, and Sludge with “ERS” —

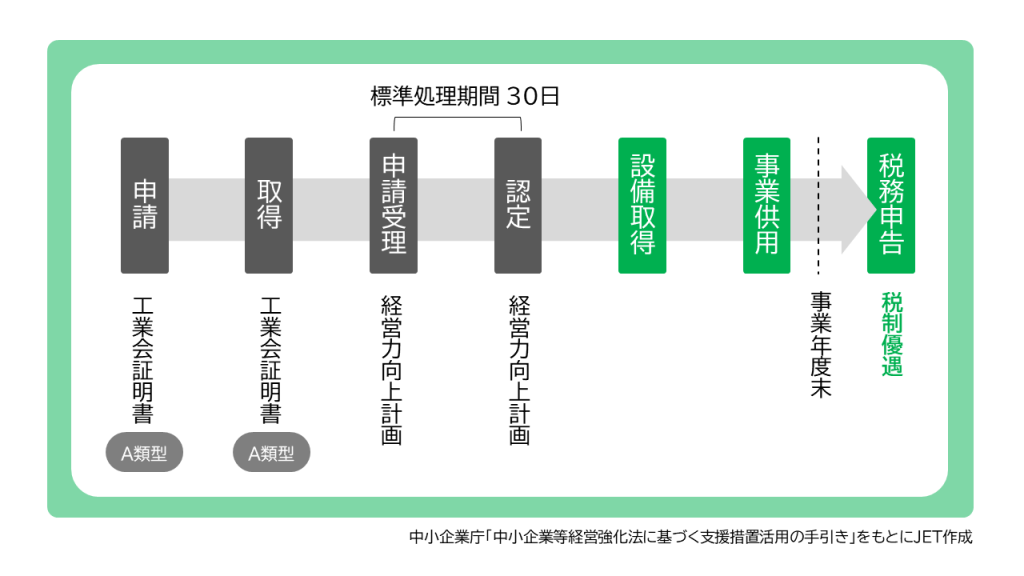

JET Corporation (Chiyoda-ku, Tokyo) has begun offering support for tax incentive procedures related to the introduction of its ERS (Rapid Fermentation and Deodorization Resource System), following the extension of the “Tax System for Enhancing SME Management (Chusho Kigyo Keiei Kyoka Zeisei)”.

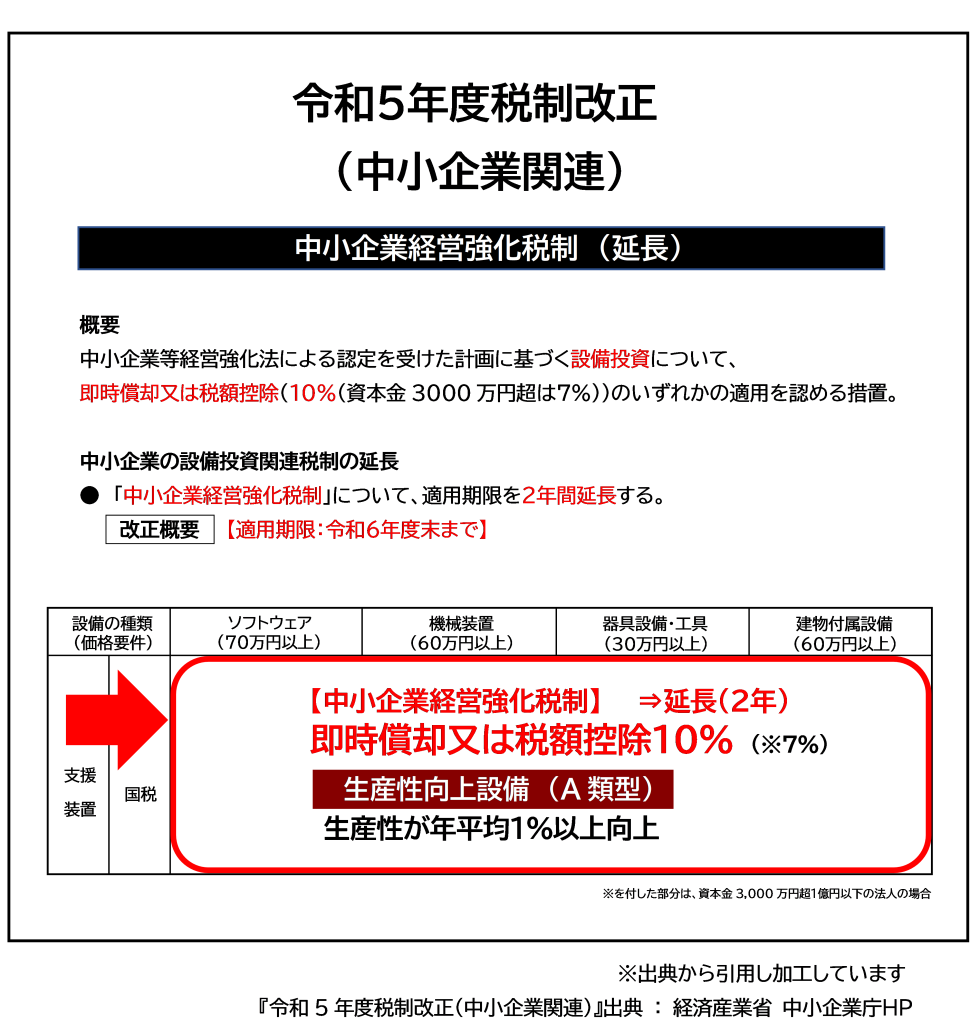

Through this extension, companies are eligible—until the end of FY2024 (March 31, 2025)—to apply immediate depreciation or a 10% corporate tax credit on the acquisition cost of ERS equipment.

This incentive promotes capital investment that enhances business efficiency in industries such as livestock, food, forestry, and energy, helping companies solve waste-related issues and strengthen their management base.

1. Promoting ERS Installation During the Preferential Tax Period

The “Tax System for Enhancing SME Management” allows small and medium-sized enterprises to receive immediate depreciation or a tax credit of 10% of acquisition cost (7% for corporations with capital between 30 million and 100 million yen) when acquiring designated equipment under an approved Business Capability Enhancement Plan.

In April 2023, the system’s expiration was extended for two years—from March 31, 2023, to March 31, 2025.

JET now provides application support for tax benefits related to the acquisition of ERS systems under this scheme.

2. Strengthening Management While Solving Operational Challenges

The ERS (Rapid Fermentation and Drying Resource System) uses microorganisms to ferment and dry organic waste (aerobic fermentation), converting it into valuable resources such as fertilizer, compost, feed, fuel, and livestock bedding.

Based on installations and trials, ERS has been successfully applied to a wide range of organic waste streams:

| Industry | Examples of Processed Materials |

|---|---|

| Livestock | Animal and livestock manure |

| Food | Processed food residues, seafood waste |

| Forestry | Plant residues, felled wood materials |

| Energy | Digestate from biogas power generation |

| Municipal | General waste, municipal solid waste, landfill waste, wastewater and river sludge, wildlife carcass disposal (gibier) |

Among these industries, odor pollution has been one of the most serious issues.

ERS eliminates odors within just a few hours of processing, while reducing waste volume and generating no wastewater.

This leads to a cleaner environment both at the site and in surrounding communities.

Furthermore, the system contributes to shorter operation times, optimized labor allocation, expanded business opportunities, increased revenue, and stronger regional relationships—ultimately reinforcing overall business resilience.

3. Example: Tax Incentive Utilization with ERS Installation

| Item | Details |

|---|---|

| Region | Hokkaido |

| Industry | Livestock farming |

| Scale | 13,000 beef and dairy cattle |

| Processed Material | Livestock manure |

| Outputs | Compost and bedding |

| Processing Capacity | 75 tons/day |

| Equipment | Three units of ERS Type-5 |

| Installation Date | March 2022 |

| Subsidy | Livestock Cluster Subsidy Project (FY2020 Supplementary Budget – Comprehensive Livestock Environmental Support Project, Compost Production and Distribution Support Subprogram) |

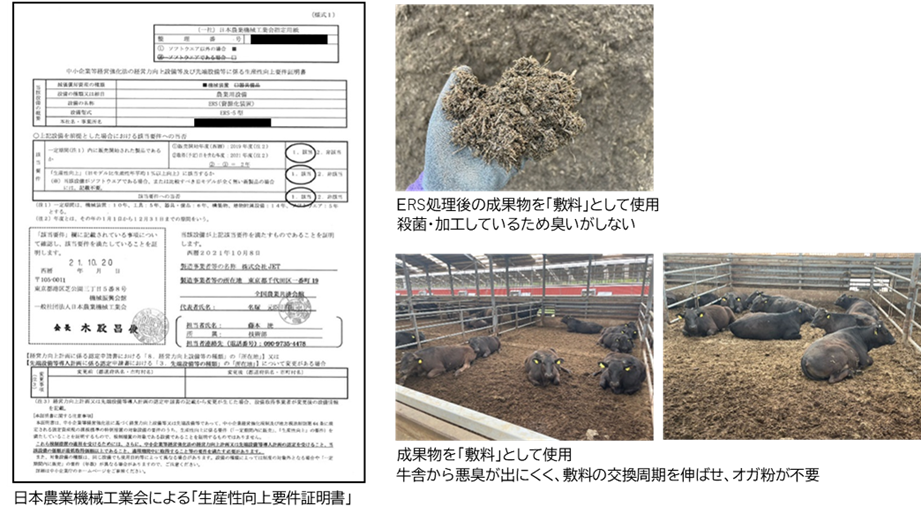

In this example, a livestock farm in Hokkaido uses ERS to sterilize, ferment, and dry cattle manure.

While conventional composting typically takes 3–6 months, ERS completes fermentation in just a few hours,

dramatically reducing both processing time and greenhouse gas emissions.

ERS eliminates harmful bacteria such as E. coli and plant seeds, and produces high-quality compost (approx. 35% moisture) in one day—without generating wastewater or odor.

The compost is also reused as bedding material, reducing bedding costs significantly.

By continuing to use existing composting facilities in combination with ERS,

the farm blends ERS-treated compost with conventional compost (approx. 60% moisture)

to achieve stable moisture levels and ensure consistent quality.

This has enabled expansion of compost sales outside the region, increasing profitability.

Because of these operational improvements, the project qualified for both the Livestock Cluster Subsidy (covering ~50% of equipment costs)

and the SME Management Enhancement Tax System,

allowing immediate depreciation or a 10% tax credit on the equipment purchase.

4. Future Outlook

▶ Promoting ERS Adoption in the Dairy Industry

- Produces odorless, wastewater-free aerobic fermented liquid fertilizer from high-moisture dairy manure.

- Meets strong demand from crop farmers for soil-friendly fertilizers, boosting local sales.

- Reduces manure processing time to just a few hours, reallocating labor toward herd expansion.

- Blending the liquid fertilizer with unfinished compost yields odorless, mature compost for stable supply.

▶ Developing a Compact ERS Model for Liquid Fertilizer Production

- Lowers initial investment through downsized equipment.

- Enables mass production of aerobic fermented liquid fertilizer within local regions.

- Helps eliminate odors affecting communities and tourism areas.

▶ Verifying ERS as a Disinfection System During Disease Outbreaks

- Aims to support rapid infection control and minimize economic losses for affected farms.